Just a note to any subscribers—this is a post about my experiment with trading stocks. I’m not sending it out to the whole group. But I’m putting it on my substack so I have an easy place to send people who are interested in it. Though I do make geeky jokes in this piece. Sorry!

Anyway: I bought the USS Enterprise with profits from trading!

Well, more like I'm thinking of getting a nice model of it. Why? Because I made a respectable profit after learning how to trade in 2024.

An author, learning how to trade? Insanity!

About a year ago, my brother-in-law,

, who makes his living trading, said he was starting a newsletter about trading (it's Brian Bakers Stock Trading Aids) and asked whether I would try it out. Since I am a writerly guy and don't always have the best relationship with numbers, I hesitated. Would I have to count using all my fingers and toes?Run away! Run away! My brain told me. Numbers are like a killer rabbit.

Then I thought, what better way to learn about the stock market and challenge my weakness with numbers? Even though I have a retirement account (RRSPS in Canada), the stock market was always something that I knew nothing about, other than every once in a while it would crash and WE SHOULD ALL FREAK OUT! NOW! It would be better for me to at least partially understand a part of the financial world that has so much influence on the "regular" world.

So I first learned that I was trading, not investing. Trading is holding shares in a stock for a shorter time and investing is holding those shares for a long time, even years. For example, if I bought shares in Apple in 1984 and sold them two days later, I would be trading. But if I instead held those stocks until today, I would be investing. I would also live in a bunker with golden toilets and a collection of actual moon rocks.

Sadly, I never bought shares in apple in 1984. I was too busy preening my mullet.

So I dove in to trading. My mind swirling with numbers.

The process of becoming a trader is relatively simple. You deposit money into an online brokerage platform. I started with CI Trading (I now also use IBKR and Wealthsimple—I'm still trying to figure out which works best for me). Luckily, in Canada, you don't have to have much money to trade, so I scraped up $1000 by writing erotic literature (kidding, I'm just seeing if you're reading along) and began following Brian's newsletter.

His type of trading is called swing trading. Swing trading is a strategy that aims to capture "swings" in financial markets over a period of days to several weeks. In his specific method we buy stocks and hold them until they gain at least 5%. Then sell! Sell! Sell! His newsletter has a better description of the methods and means of limiting your risk. He has a very conservative approach that is still profitable. In the space of a year, out of the 100s of stocks that I've bought and sold, the only loss I took was when one went bankrupt (Bowflex of all things! Don't people love exercise). And one other loss occurred when I put in the wrong sell price. Ugh! Always be careful with that.

Buying my very first shares in a stock made beads of sweat appear on my forehead. Would I make a mistake? Punch in the wrong numbers? Bring down our entire society and get tweeted at by Elon Musk? Nope, instead I hit buy, using the price listed in Brian's newsletter, and the order went in. Once the shares were bought, I set the price I wanted it to sell at and waited. It is a joyously uplifting moment when a stock sells. In fact, I am told an angel of capitalism gets its wings each time! Then I entered the information into a very, very evil thing.

A spreadsheet!

Yes, I have a spreadsheet! I have always feared them. Now I live by it.

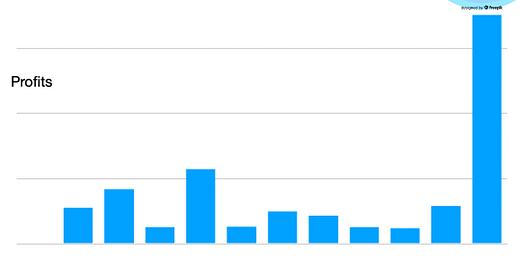

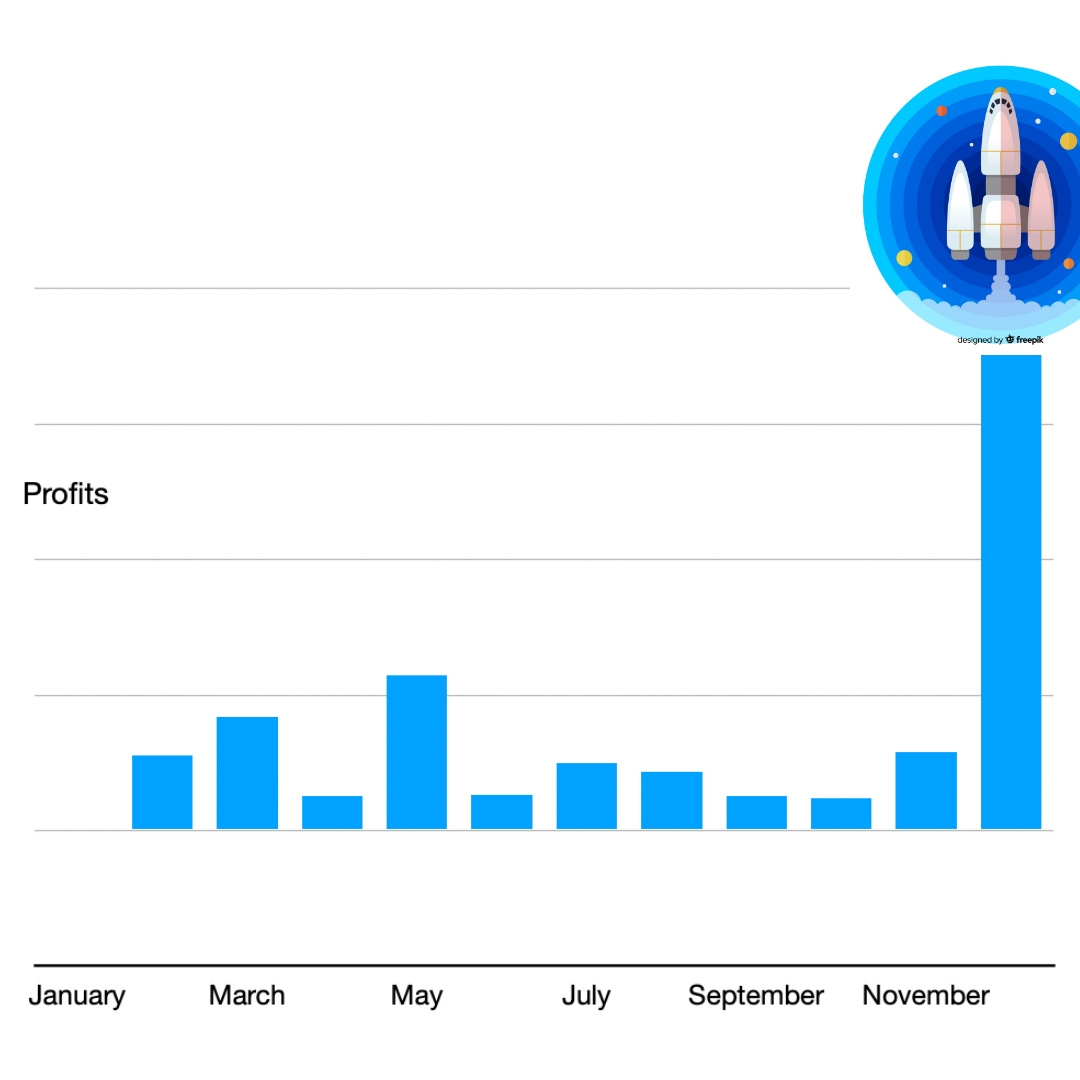

By the end of the year, I had made at least a 28% gain in my investments. I say at least because I kept adding more money to the pot here and there, making it hard to define exactly how much was invested at which time (it is likely a slightly larger gain than 28%). But here is a chart that shows the profits each month:

The blue bars go up and down and then they go way up in December. That was partly because one stock sold at a 276% gain instead of the usual 5%. A rare day! And I also added a larger sum to the pot that month, which meant I could buy more shares of stocks. And Brian had refined his methods, and that made a difference in how quickly stocks were selling. The numbers for January, so far, are consistently climbing.

Overall, it really only takes about 30 minutes in the morning to read the newsletter and enter my share prices. Then the buys and sells are handled automatically by the online brokerage. I check the numbers once or twice during the day, which takes another 15 minutes of time.

Are there negatives? The money, because it's in stocks that may be low for a few weeks, can't easily be withdrawn without a loss. But this isn't money I live on. I'm building enough capital so that I can easily withdraw profits in the future.

The one thing that I haven't learned and will be a longer learning curve for me is how to predict what stocks to buy. Brian's newsletter (and the occasional coaching lesson) is very helpful. But I need to spend more time to get to that point.

Sadly, I also need to write my books... so like everything, it's finding the balance.

The best thing is that this entire process is thoroughly engaging, and it taught me to not fear or dismiss the stock market. It's our dark oligarch overlords that I fear!

What would success be? That's obvious: buying a hobbit hole with a golden toilet. That's my golden goal!

As always, with anything in life, if you try stock trading, your mileage (kilométrage in Canada) may vary.

But as we say in the stock world: Live Long And Prosper.

Or was that the Spock world?

Very interesting. And quite brave, lol.

What would Brax say?